ACNC Charities Part III: Public Benevolent Institutions

This article (Part III) will outline what Public Benevolent Institutions (“PBI“) are, prerequisites for entities seeking to become PBIs, and some of the advantages of becoming PBIs.

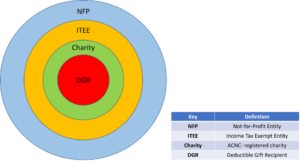

In Part I of this series, an entity meeting the Australian Charities and Not-for-profits Commission’s (‘ACNC’) prerequisites can register with the ACNC as a charity, leading to entitlement to a range of tax exemptions and concessions if registered successfully.

In Part II, we outlined that many ACNC-registered charities might also choose to apply for Deductible Gift Recipient (‘DGR’) status for their entire entity or a particular arm of their entity’s functions – enabling donors to deduct these donations from their personal income for tax purposes (which often encourages more frequent and substantial donations from donors).

However, very specific charities meeting stringent threshold requirements might choose to apply to the ACNC for Public Benevolent Institution (“PBI”) status.

What are Public Benevolent Institutions?

A Public Benevolent Institution is one of the 14 subtypes of charities recognized by the ACNC under section 25-5 of the Australian Charities and Not-for-Profits Commission Act 2012 (Cth) as being eligible for registration as a charity. PBIs differ from other charitable subtypes in that their main purpose is to relieve the poverty, sickness, disability, destitution, suffering, misfortune, helplessness and/or distress of people in need. [i] Put simply – PBIs provide “benevolent relief to people in need”.[ii]

Typical examples of PBIs might include:[iii]

-

- Entities that provide housing assistance to people suffering from poverty;

-

- Entities providing support services for people with a disability;

-

- Particular types of aged-care services – normally situations where aged-care services are provided on a not-for-profit basis; and

-

- Hospitals meeting PBI prerequisites.

Advantages of Becoming a Public Benevolent Institution

Public Benevolent Institutions have an extensive range of taxation benefits potentially available to them. These can include:

-

- All Commonwealth taxation benefits generally available to charities (such as income tax exemption, refunds of franking credits, and GST concessions for charities);

-

- DGR endorsement and a DGR category specifically for PBIs (provided that the PBI meets the requirements for DGR endorsement – see Part II); and

-

- Fringe Benefits Tax exemptions.

Prerequisites of Becoming a Public Benevolent Institution

Because of the substantial benefits and tax exemptions/concessions available to Public Benevolent Institutions, the threshold requirements for any entity to obtain PBI status are significantly higher than for obtaining other types of charitable statuses. An entity will only be granted PBI status once registered by the ACNC as a PBI.

Registration requires an entity to:

1) be a charity (according to the legal meaning of “charity”);

2) be an institution;

3) have benevolent relief as its main purpose; and

4) provide the benevolent relief to people in need.

In considering whether the organisation will meet the PBI registration requirements, the ACNC will consider material such as the entity’s governing documents, financial statements, operational plans and activities amongst other things.

1. Entity is a “Charity”:

See Part I as to what it means for an entity to be legally recognized and registered as a “charity” with the ACNC.

2. Entity is an “Institution”:

The entity seeking PBI status must be an “institution” – this normally being “an establishment, organisation, or association, instituted for the promotion of some object, especially one of public utility, religious, charitable, educational etc”.[iv]

An “institution” can be an entity such as a corporation, trust or unincorporated association with its own separate identity, that:[v]

-

- Either:

-

- Has its own activities or provides its own services;

-

- Participates in a relationship of collaboration with other entities that is organized and conducted for / promotes benevolent relief; or

-

- Engages other people or entities to engage in activities on its behalf;

-

- Either:

-

- And:

-

- Is not merely a fund; or

-

- Does not simply manage trust property that is used for benevolent purposes.

-

- And:

-

- And:

-

- “Brings into being the charitable purposes and intentions of its founders.”[vi]

-

- And:

3. Benevolent Relief as the entity’s Main Purpose:

The charity must have, as its main purpose, to provide “benevolent” relief to people in need. This is not necessarily limited to providing financial relief, but rather also extends to other types of relief (relief from sickness, disability, destitution, suffering, misfortune or helplessness, poverty or distress).[vii] The PBI can have additional purposes, provided that these purposes are “ancillary” or “incidental” to the main benevolent purpose.

Benevolent purposes are exclusively human needs (such as relieving human poverty, human health, human suffering etc.), and these human needs can exist overseas. However, this means that any organisation that provides relief to the suffering of animals will unlikely be registrable as a PBI.[viii]

Furthermore, the ACNC indicates that the level of distress suffered by the people in need that the entity seeks to relieve will also be relevant to the ACNC’s assessment of whether the entity is registrable as a PBI. The ACNC describes the requisite level of distress suffered by the disadvantaged people as needing to be:[ix]

-

- Significant enough (and the circumstances difficult enough) to arouse compassion in people in the community;[x]

-

- Beyond the suffering experienced as part of “ordinary daily life” (which are distresses that a person would normally be able to get through themselves after enough time has passed);[xi] and

-

- Concrete enough – aimed at helping people who are recognisably in need of benevolence.

4. Provide the Benevolent relief to people in need

The services provided by the PBI must be relieving the poverty/distress suffered by the people in need – not merely providing services to people in need.

Benevolent relief can be provided by the PBI directly to the people in need or through associated entities.[xii] In the case of the latter, the ACNC consider whether the entity’s activities are organized and conducted for the purpose of relieving the poverty or distress of people in need.[xiii]

The relief that the Public Benevolent Institution provides must also be specific and tailored to a particular group of people who are recognised to be in need – it cannot be provided to the broader general community, as it is assumed that people in the broader community are not in need of “benevolent relief”.[xiv]

If you are investigating whether your charity would best operate as a Public Benevolent Institution, the friendly team at Corney & Lind Lawyers can help. Contact us today on (07) 3252 0011 or email us at enquiry@corneyandlind.com.au

Related Articles

https://corneyandlind.com.au/not-for-profit/charity-status/

https://corneyandlind.com.au/not-for-profit/deductible-gift-recipient-status/

Footnotes

[i] Perpetual Trustee Co Ltd v FC of T (1931) 45 CLR 224.

[ii] Australian Charities and Not-for-profits Commission (‘ACNC’), ‘Commissioner’s interpretation Statement: Public Benevolent Institutions’ CIS 2016/03 (Interpretation Statement, accessed 3 November 2022) < https://www.acnc.gov.au/tools/guidance/commissioners-interpretation-statements/commissioners-interpretation-statement-public-benevolent-institutions>.

[iii] ACNC, ‘Examples of Public Benevolent Institutions’, Public Benevolent Institutions and the ACNC (Factsheet, Accessed 19 September 2022) <https://www.acnc.gov.au/tools/factsheets/public-benevolent-institutions-and-acnc>; Australian Taxation Office, ‘Public Benevolent Institution’, Types of Charities (Webpage, 12 October 2016) <https://www.ato.gov.au/Non-profit/Getting-started/In-detail/Types-of-charities/Public-Benevolent-Institution/>.

[iv] Shorter Oxford English Dictionary; Young Men’s Christian Association of Melbourne v FC of T (1926) 37 CLR 351.

[v] ACNC, ‘Public Benevolent Institutions and the ACNC’, Factsheets (Factsheet, accessed 3 November 2022) <https://www.acnc.gov.au/tools/factsheets/public-benevolent-institutions-and-acnc>.

[vi] ACNC, ‘Commissioner’s interpretation Statement: Public Benevolent Institutions’ CIS 2016/03 (Interpretation Statement, accessed 3 November 2022) <https://www.acnc.gov.au/tools/guidance/commissioners-interpretation-statements/commissioners-interpretation-statement-public-benevolent-institutions>.

[vii] ACNC, ‘Commissioner’s interpretation Statement: Public Benevolent Institutions’ CIS 2016/03 (Interpretation Statement, accessed 3 November 2022) <https://www.acnc.gov.au/tools/guidance/commissioners-interpretation-statements/commissioners-interpretation-statement-public-benevolent-institutions>, cl 5.1.1.

[viii] FC of T v Royal Society for the Prevention of Cruelty to Animals, Queensland Inc 92 ATC 4441.

[ix] ACNC, ‘What is a ‘main purpose of benevolent relief’?’ Public Benevolent Institutions and the ACNC (Factsheet, Accessed 21 September 2022) <https://www.acnc.gov.au/tools/factsheets/public-benevolent-institutions-and-acnc>.

[x] Pay-roll Tax, Commissioner of (Vic) v The Cairnmillar Institute (1990) 90 ATC 4752.

[xi] ACNC, ‘Commissioner’s interpretation Statement: Public Benevolent Institutions’ CIS 2016/03 (Interpretation Statement, accessed 3 November 2022) <https://www.acnc.gov.au/tools/guidance/commissioners-interpretation-statements/commissioners-interpretation-statement-public-benevolent-institutions>.

[xii] FC of T v The Hunger Project Australia [2014] FCAFC 69.

[xiii] ACNC, ‘Does my charity have to provide benevolent relief directly?’, Public Benevolent Institutions and the ACNC (Factsheet, Accessed 19 September 2022) <https://www.acnc.gov.au/tools/factsheets/public-benevolent-institutions-and-acnc>; Australian Taxation Office, ‘Public Benevolent Institution’, Types of Charities (Webpage, 12 October 2016) <https://www.ato.gov.au/Non-profit/Getting-started/In-detail/Types-of-charities/Public-Benevolent-Institution/>.

[xiv] Australian Council of Social Service Inc v Commissioner of Pay-roll Tax (1985) 1 NSWLR 5